The Chinese new year and the Brazil and China relationship

11/02/2021Welcome to the Chinese new year 4719, ruled by ox and the metal element. Understand more about this date and the historical commercial relationship between Brazil and China.

The Chinese calendar is the world’s oldest and takes both the Sun and the Moon into consideration. The year has twelve lunations (354 days), and every three years, it adds one month more to match the solar year (365 days).

The Chinese horoscope has twelve signs, and each year is influenced by a sacred animal. We were in the year of the rat and now entered the year of the ox. The animal’s influence is expected to bring prosperity to business, incentive logical thinking, convenience, and consistency. The main virtues for 4719 are patience and perseverance.

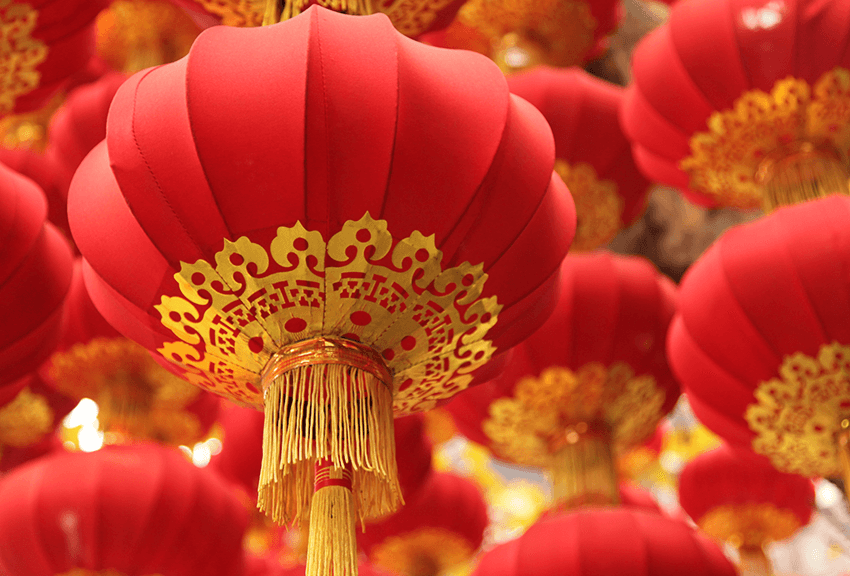

Celebration in Chinese culture

The Chinese new year the most important holiday in country. The whole country stops for 1 or 2 weeks, and millions of people travel to visit their families. Therefore, the celebration may affect business and imports in this period.

According to tradition, couples and older people give the younger ones a red envelope (hong bao) with money, always with new bills and in even number. But it must not be opened right away.

Brazil-China trade chain

In 2020, China became the largest trading partner in Brazil’s history. For the first time, the Brazilian trade chain with a country exceeded the amount of US$100 billion. The imports and exports between the two countries accounted for US$ 101,728 billion, according to SECEX.

China is our main trading partner since 2009. The relationship went through two significant moments: the increase in Chinese exports to Brazil in the 1990s, due to currency pairing of Real with the Dollar, and the increase in Brazilian exports to China in the 2000s, due to the commodities boom.

The main products exported to China are soybeans, meat, iron ore and oil. Bilateral exports jumped from US$ 16 billion in 2008 to US$ 67 billion last year. Brazilian imports demand a wide range of Chinese manufactured products.

Foreign direct investment

According to PwC, there were 83 Chinese investment operations in Brazil from 2010 to 2019, totaling US$ 55.1 billion. The main sectors targeted by investors are related to infrastructure and commodities, such as electric power, ports, airports, oil and oil by-products, mining, agriculture and vehicles.

Chinese investment reached the Brazilian technology sector recently. The most significant operation was the acquisition of 99 App by Didi Chuxing for approximately US$ 600 million.

Bexs has the only platform via API combining payments and FX. Our tailored solution for global digital companies helps to localize the payment experience and scale business in Brazil. Click here and contact our experts.